7th November 2020, Skopje – Legal amendments to 22 measures out of total of 31 measures under the fourth set, being under Ministry of Finance competence, have already been adopted or are in parliamentary procedure, or are being prepared and published on the Single National Electronic Register, for public consultation. This was pointed out by Minister of Finance Fatmir Besimi at the joint press conference with the Director of the Public Revenue Office Sanja Lukarevska, at the occasion of adoption of the laws on financial support for employers and persons performing independent activity, aimed at paying wages, being adopted by the Parliament.

– Ministry of Finance is in charge of the measures under the fourth set, being envisaged under the Supplementary Budget, and they can be divided into four categories, as follows: measures for direct financial support to companies, measures for financial support to citizens, tax relief and measures pertaining to systemic solutions. These funds will be provided as support to the private sector and the citizens, during the second wave of COVID-19, and they will further contribute to the economic recovery. It is worth mentioning that the measures are designed so they can have positive effects on both the supply and consumption side, thus cushioning the consequences of the crisis. Minister of Finance Besimi said.

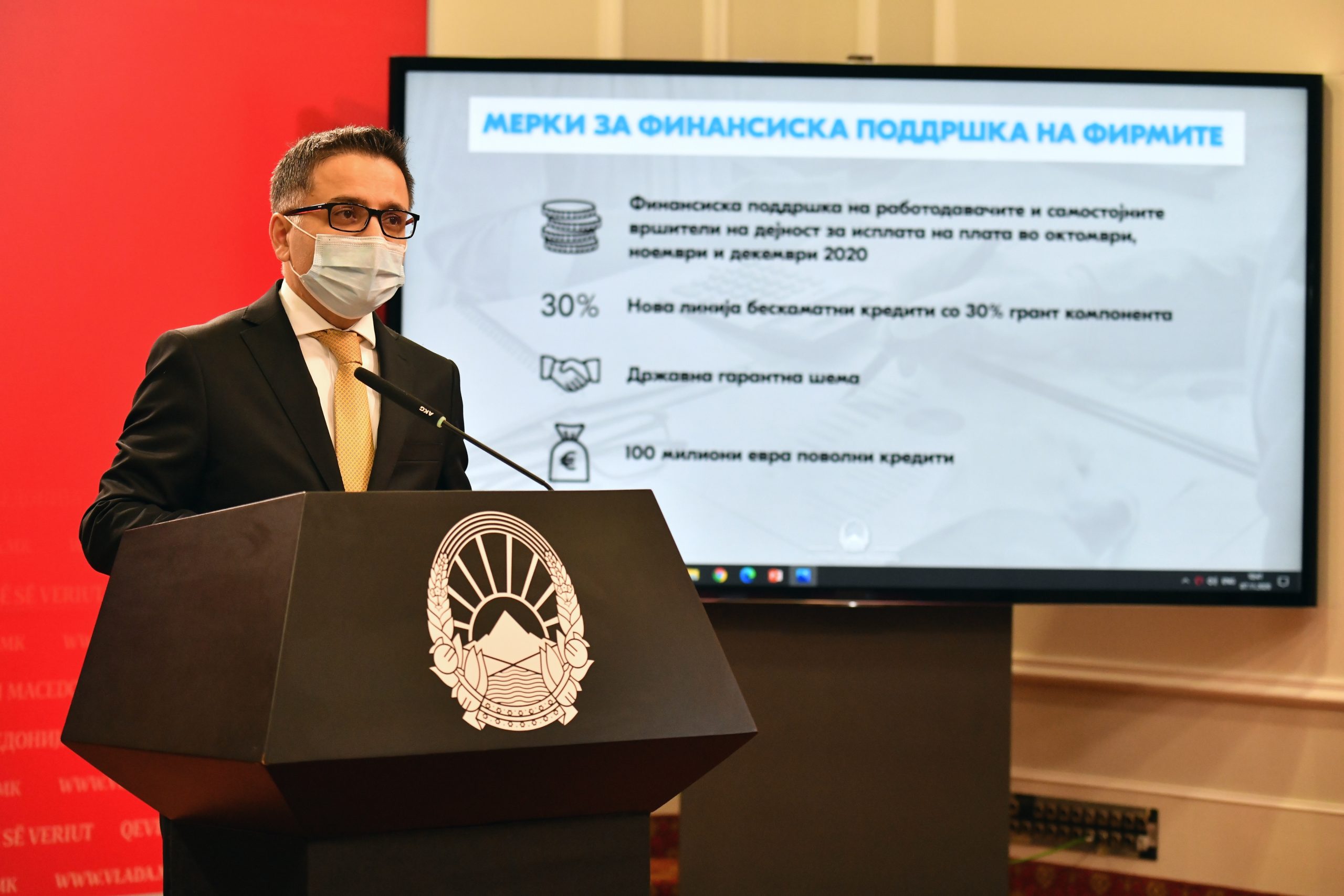

As for the measures for financial support to enterprises, Minister pointed out the financial support to employers and the persons performing independent activity, aimed at paying October, November and December 2020 wages, for which the laws have already been adopted by the Parliament, and which application should commence. Furthermore, new interest-free credit line with 30% component, which measure has already been designed and the Government expects for the funds to be made available to the companies during this month or at the beginning of the next one. With respect to the state loan guarantee, as Minister pointed out, the Law has been already prepared, being published on the Single National Electronic Register, for public comments, while as regards the additional EUR 100 million as loans under favourable terms and conditions from the Development Bank, negotiations about the funds with EIB have been already commenced, and they are expected to be made available to Macedonian companies at the beginning of next year.

Director of Public Revenue Office Lukarevska, by referring specifically to the measure for financial support to employers, said that the measures aimed at keeping the job of every employed person, were a top priority of the Government, the Ministry of Finance and the Public Revenue Office, through which they are implemented. The Director mentioned the conditions and the manner of using the measure, which starts by electronic submission of the application for financial support for paying wages to the employees, through e-tax, after which the Public Revenue Office will respond to the completeness of the application immediately or within 3 days at the latest. Financial support will be paid by 15th in the current month for the previous month.

Under the measures for financial support to citizens, Minister of Finance Besimi pointed out that the with resect to the measure for financial support in the amount of Denar 6,000 aimed at the vulnerable categories of citizens, for which the respective law has been already prepared and approved by the Government, it is expected for the citizens to be able to use these funds in the next month already. With respect to VAT-free weekend measure, Minister said that the measure was implemented and that the repayments thereof should begin as of next week.

As for measures related to tax exemptions and exemptions from duties, implemented by the Ministry of Finance, Besimi pointed out that reduction of VAT on restaurant services and serving food and beverages from 18% to 5%, the possibility to pay upon VAT application following its submission within 5 days at the latest, rather than on the same day – all these measures are governed under the Draft Law on Amending the VAT Law, which has already been approved by the Government, being under parliamentary procedure. They should enter into force as of 1st January 2021, while the extension of the VAT payment deadline enters into force upon the adoption of the law.

– Moreover, the tax relief also covers the measure for deferred payment of profit tax and personal income tax advance payments for persons performing independent activity. Amendments to these laws have been already approved by the Government, being in parliamentary procedure and they are expected to be adopted during this month. Other measures are also governed under these laws, such as: raising the threshold under which the entities would not be subject to PT taxation regime, profit tax and personal income tax exemption for employee-related costs pertaining to additional qualifications and team building, recognizing private health insurance costs of the employees for profit tax purposes and not being subject to personal income taxation, recognizing the costs for COVID-19 testing, as an eligible cost and extension of the period for covering losses to be set off against future profits. Reduction of the default interest on public duties by half, which will apply until March 2021 – Besimi said.

As for the measures pertaining to systemic solutions for financial sustainability and digitalization by the Ministry of Finance, Beismi indicated the introduction of e-invoicing platform, a systemic solution, which will be implemented throughout 2021, being important from the aspect of supporting the digital payments. The second one is changing the calculation for the base for financing local government units, under which, when allocating funds to the local government units, the calculation of the average VAT collection in the previous three years will be taken into account, instead of the previous year alone as so far.

Besimi pointed out under the Supplementary Budget, EUR 160 million has been provided as budget funds, being intended for financial support for paying wages, financial support for vulnerable categories, support for producers, manufacturers and exporters of grape and wine, support for tourist guides, tourist tax refund for 2019 for realized overnight stays, VAT refund from the VAT-free weekend with “MyVAT”, state loan guarantee and customs bank guarantee through the Development Bank and grants for travel agencies, kids’ play areas and restaurants for weddings.