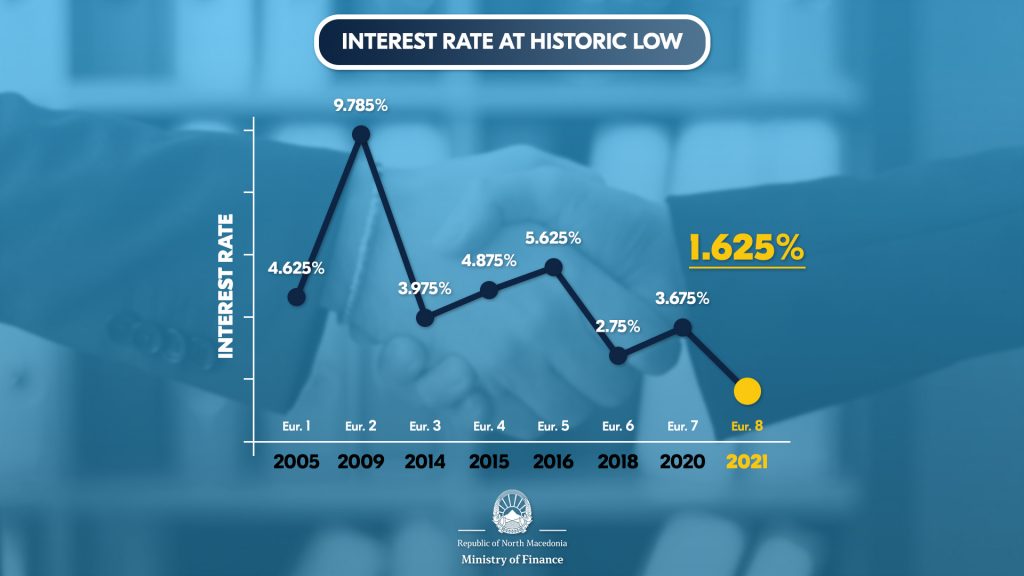

4th March 2021, Skopje – Investors’ confidence in the credibility of our economy and the policy actions being undertaken, is increasing, thus reducing the interest rate on the Eurobond they would be interested to purchase. The eighth Eurobond was issued at convincingly lowest interest rate of 1.625%, recording many-fold decrease compared to all previously issued Eurobonds in the country, also being lower than the interest rates, upon which the other countries in the region issued the respective Eurobonds not long ago. If we make a comparison with the Eurobond issued in 2014, which should be refinanced from the eighth Eurobond, the interest savings amount to EUR 82.25 million, as Minister of Finance, Fatmir Besimi pointed out at today’s press conference at the occasion of issuing the eighth Eurobond.

At yesterday’s auction, demand of international investors was 2.3 times higher. In fact, the offer for the eighth Eurobond amounted to EUR 700 million, i.e. more than 130 investors were interested to purchase it, with the demand reaching over EUR 1.6 billion. This is particularly encouraging from the aspect of the international capital market given that the outlook of Macedonian economy and its potential in the eyes of international investors, have significantly improved in only 9 months. Thus, interest rate on the seventh Eurobond, issued at the beginning of COVID-19 crisis in June 2020, accounted for 3.625%. At present, the interest rate accounts for 1.625% or by 2.05 percentage points less. During this period, implementation of the adopted third, fourth and fifth set of anti-crisis measures started, which together with the other policy actions, inspire investors with confidence in our economy. Hence, cost of capital is at exceptionally low interest rate, being approximately the same with the cost of national government securities with similar maturity. When comparing the other Eurobonds issued in times of global economic crisis, i.e. the Eurobond issued in 2009, the interest rate of which accounted for 9.875%, the difference is even more evident, Minister said.

He pointed out that if we make comparison with the other economic in the region and broader, having issued Eurobonds in the last several months, the interest rate on the Eurobond issued in our country is lower, thus reflecting boosted confidence of investors in our economy, thus reflecting boosted confidence of investors in our economy,

– Last week, Croatia issued two Eurobonds amounting to EUR 1,000,000,000 each, the interest rates of which account for 1.75% and 1.125%, respectively. Furthermore, Serbia also issued Eurobond on the international capital market, being worth EUR 1,000,000,000 with an interest rate accounting for 1.65%. Eurobonds issued by Turkey at mid-January this year, amounted to EUR 1.75 billion, the interest rates of which accounted for 4.75% and 5.875%, respectively. In December last year, Ukraine issued Eurobond worth EUR 600 million, with an interest of 7.253%. At the beginning of December last year, Montenegro issued Eurobond worth EUR 750 million, with an interest of 7.253%. Furthermore, at the end of November, Romania issued two Eurobonds, the first amounting to EUR 1,500,000,000 with an interest rate of 2.625%, and the other one amounting to EUR 1,000,000,000, the interest rate of which accounted for 1.375%. In the course of November last year, Turkey also issued Eurobond, amounting to EUR 2.3 billion with an interest rate of 5.95%, as well as Serbia, the issued Eurobond of which amounted to EUR 2,000,000,000 with an interest rate of 2.125%, Besimi said.

Minister pointed out that although the eighth issued Eurobond amounts to EUR 700 million, net issuance on the basis of this Eurobond amounts to EUR 200 million. In facts, the funds under the eighth Eurobond, will be used for refinancing the Eurobond issued in 2014, amounting to EUR 500 million. The 2014 Eurobond was issued at an interest rate of 3.975%, with a 7-year maturity or by 2.35 percentage points higher compared to the currently issued Eurobond, meaning that around EUR 82.25 million will be saved on the basis of interest.

When the 2021 Budget was adopted, it was pointed out that despite the budget deficit of EUR 568.1 million, being mostly a result of the COVID-19 crisis-related needs, the external debt amounting to total of EUR 605.6 million should be repaid, also including the Eurobond issued in 2014, thereby also taking into account the repayment of domestic debt on the basis of previously issued government securities and structural bonds, amounting to EUR 99.5 million. Remaining funds will be provided by issuing government securities on the domestic market, via favorable development loans from international organizations, as well as by using the deposits transferred from 2020 as buffers, Minister Besimi said.

By taking into account the commitments and the labilities falling due to be repaid, according to the projections of the Ministry of Finance, the general government debt will account for 53.2%, while the public debt will account for 63.4% at the end of the year.