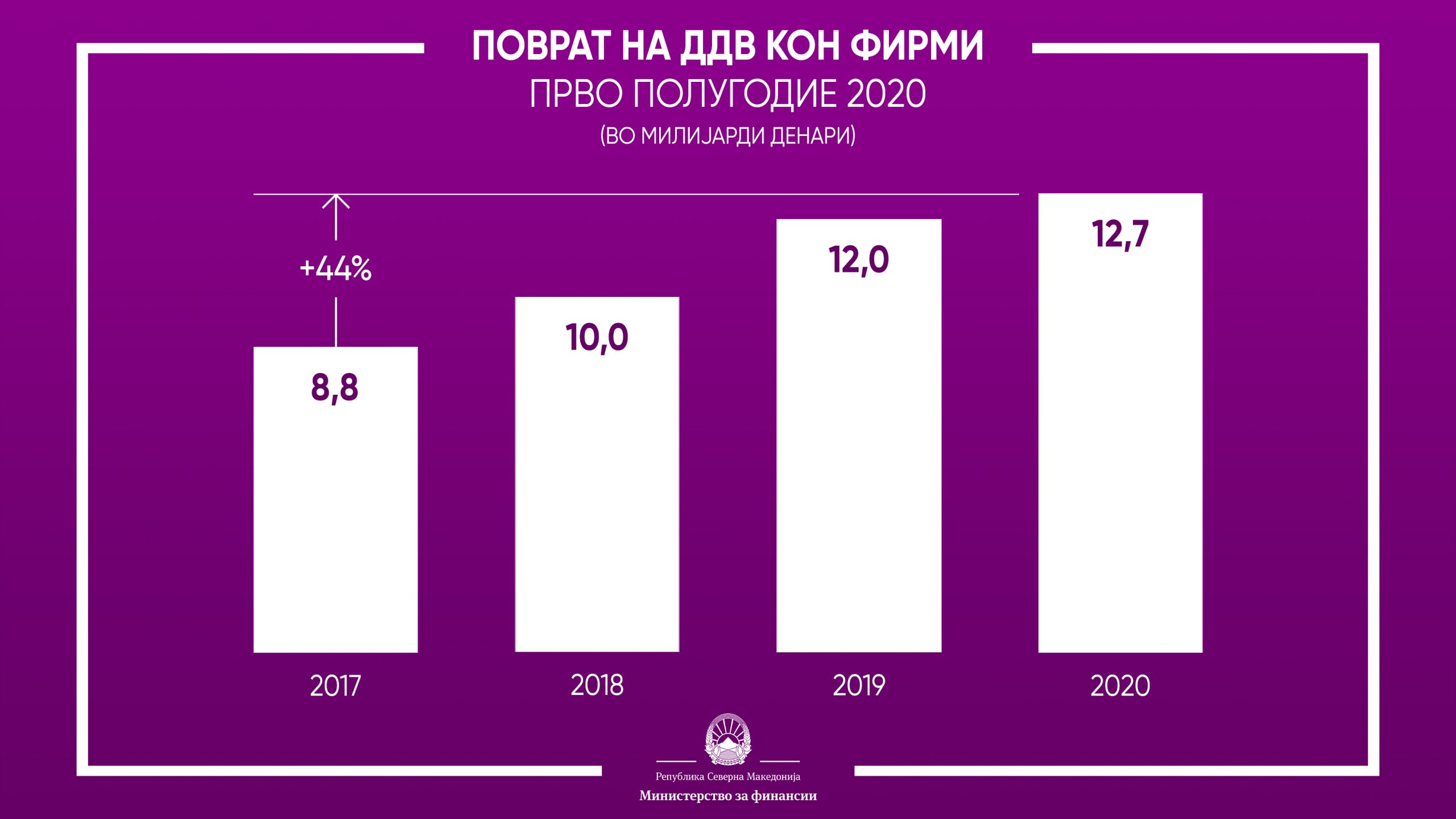

3rd July 2020, Skopje – VAT in the amount of Denar 12.7 billion or EUR 206.5 million was refunded to the companies in the first half of 2020, being by 6% or by Denar 660 million more compared to last year. This is the highest VAT refund for the respective period in the past years, which is significant taking into account the COVID-19 crisis.

Compared to the previous two years, VAT refund is significantly higher. Hence, if the first half of 2020 is compared with the same period in 2018, the refund is by 26% higher, while compared to 2017, it picked up by high 44%.

VAT refund to companies amid COVID-19 crisis is of great significance, in terms of maintaining liquidity of the business sector, thus boosting and supporting the economic activity.

Yesterday, while presenting the budget execution in the first half of 2020, Minister of Finance, Nina Angelovska, pointed out that Ministry’s priority was to service all its liabilities on regular basis and in a timely manner.

– Goal of the Ministry of Finance is to ensure continuous execution of the Budget, without any delays, within the legally set deadlines: employees to receive their wages, socially vulnerable groups to timely receive their allowances, companies to timely collect their receivables from the budget users, no arrears, as well as VAT to be timely refunded to the companies. COVID-19 measures are put in place, a support the Government extends to both the citizens and the companies, in line with the possibilities, through the domestic payment card, the subsidized wages and contributions, postponing the tax-liability payments. What remains as an obligation and a responsibility of the Government is to provide for and deliver public goods and services to all, especially now, in such troublesome times, Angelovska said.

Still, in 2019, companies were refunded VAT in the amount of EUR 402 million, being by 7.5% more compared to 2018 and by even 44% more compared to 2016.