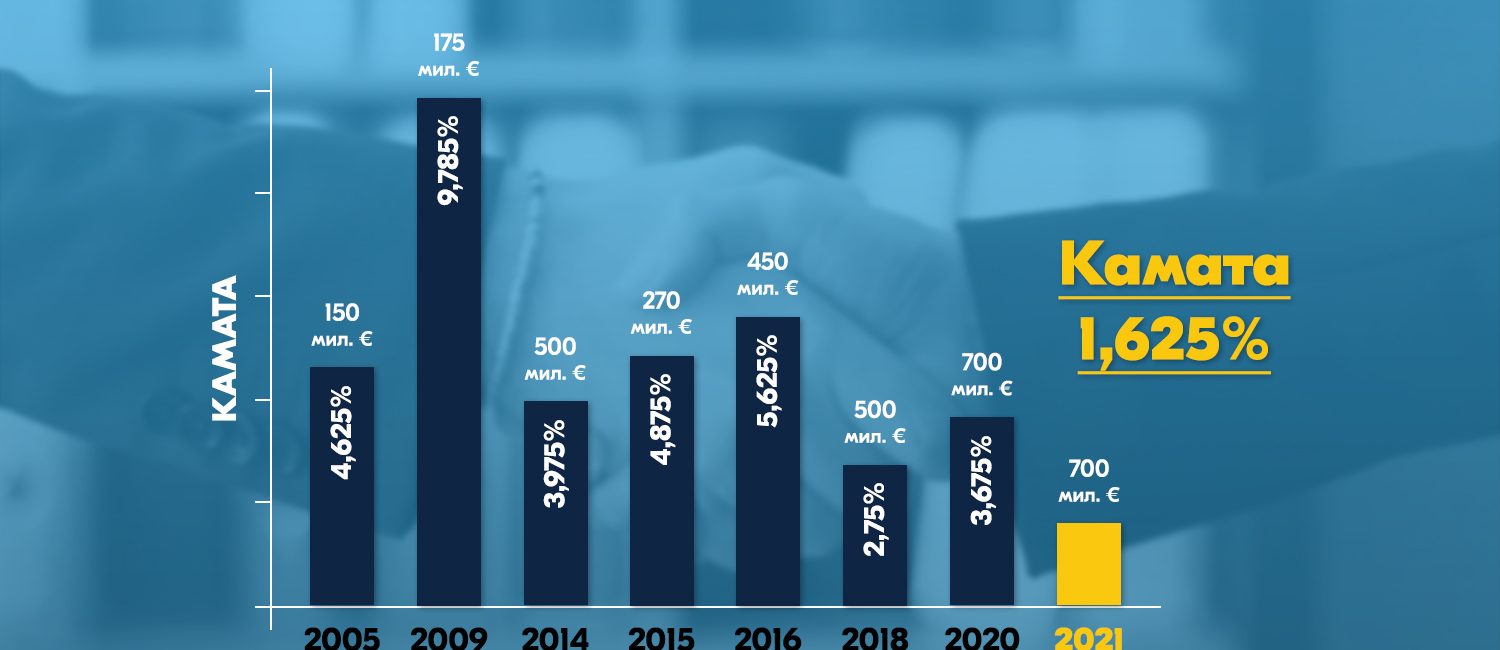

3rd March 2021, Skopje – Republic of North Macedonia has issued the eight Eurobond so far, which took place on Wednesday. Eurobond amounts to EUR 700 million with a 7-year maturity period, being issued at historically low interest rate of 1.625%. It will be used for refinancing the third Eurobond issued in 2014, amounting to EUR 500 million. Net issuance on the basis of this Eurobond amounts to EUR 200 million.

Exceptionally favourable interest rate, despite COVID-19 crisis, speaks in favour of the prudent macroeconomic policies and the maintained crediting rating of the country. Maintaining the credit rating, and thus the confidence of investors, is a result of the taken policy actions, as well as the four sets of measures aimed at coping with the effects of the crisis. Great confidence of the investors is also reflected through the large number of investors interested in purchasing the Eurobond, i.e. more than 130 investors were interested to purchase twice higher amount than the one offered, with the demand reaching over EUR 1.6 billion.

As being indicated when adopting the 2021 Budget, funds provided by issuing this Eurobond, will be used for repaying the external debt, including the Eurobond issued in 2014, falling due to be repaid this year. Remaining funds will be used for financing one portion of the budget deficit. The 2014 Eurobond amounted to EUR 500 million, being issued at an interest rate of 3.975%, meaning that the interest, at present, is lower by 2.35 percentage points.

However, the country has previously issued seven Eurobonds on the international capital market, the interest rate of which accounted for 4.625% in 2005, 9.875% in 2009, 3,975% in 2014, 4.875% in 2015, 5.625% in 2016, 2.75% in 2028 and 3.675% in 2020.

In the light of fiscal transparency and accountability, Minister of Finance Fatmir Besimi held a press-conference the next day.