11th February 2020, Skopje – Increased fairness of taxation, improved revenue collection, increased tax transparency, improved quality of services and introduction of green taxation, are the priorities of the 2020-2023 Tax System Reform Strategy, being presented today, as well as discussed with the business community, the non-government organizations and the experts. This event was attended by Minister of Finance Nina Angelovska, Vice Prime Minister in chare of Economic Affairs Mila Carovska and the Deputy Minister of Finance Shiret Elezi.

Minister of Finance Angelovski pointed out that during the fast globalization of trade and financial systems, the liberalization of the flow of goods and capital and the progress in the field of information and communication technology, require specific strategy on the basis of which, specific action measures will be prepared.

– Main purpose of the Strategy is to ensure that the tax authorities in the Republic of North Macedonia behave in an efficient, coordinated and consistent towards achieving a common goal – inclusive and sustainable economic growth. Strategy will address the issues such as grey economy, economic inequality, difficulties in collecting public revenues, sophisticated techniques for tax avoidance and evasion, as well as increasing environmental risks – Angelovska said.

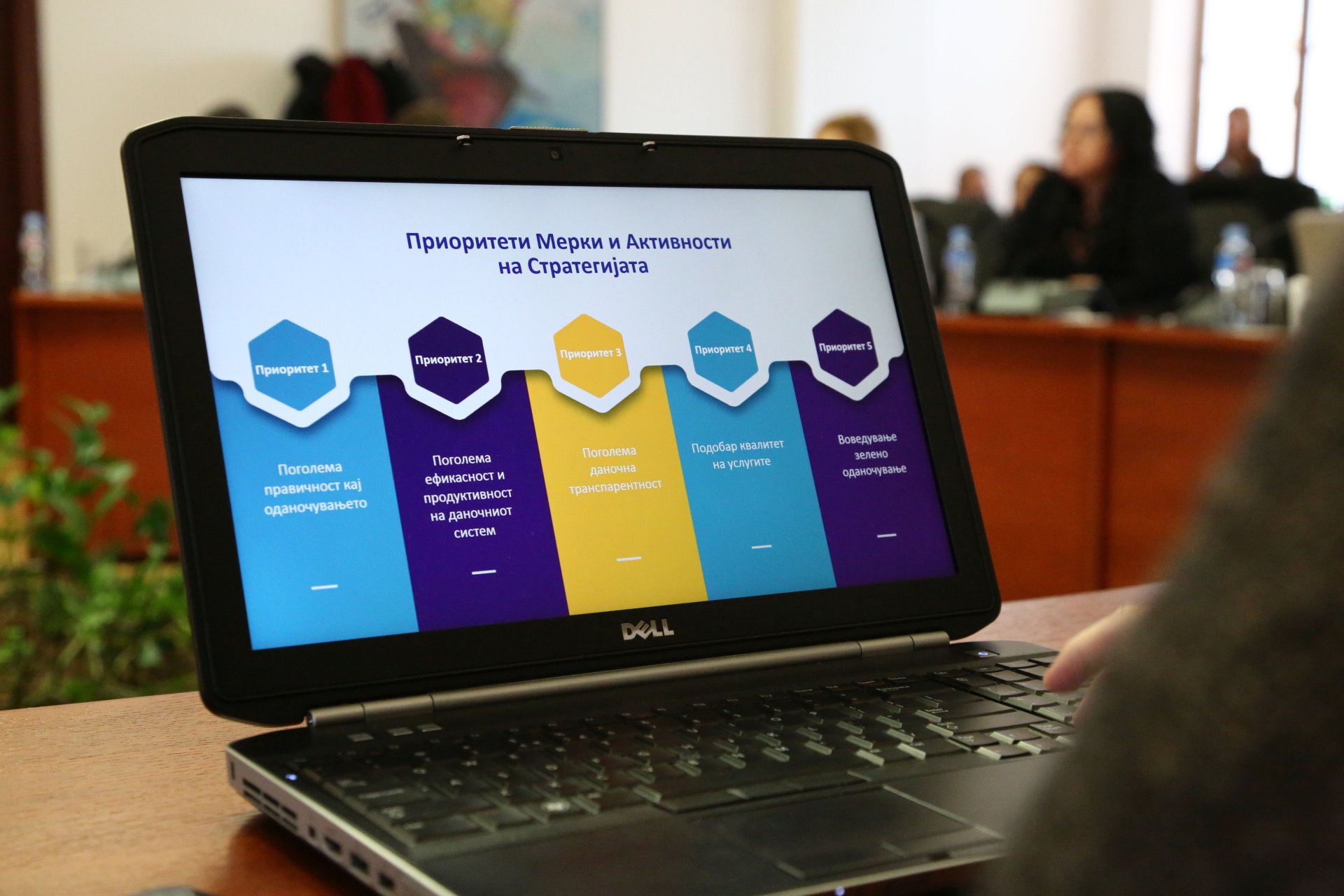

The Strategy, the preparation of which was also supported by the Delegation of the European Union to the Republic of North Macedonia and the Ministry of Finance of The Kingdom of Netherlands, comprises five priorities.

The first priority is fairness of taxation, in order to ensure that everyone meets its social obligation and pays its fair share of tax. The second priority is increased efficiency and productivity of the tax system for the purpose of improved revenue collection, more efficient fight against illicit activities and tax evasion, and a strengthened institutional capacity, analysis and finalization of the tax bases, reduction of the tax arrears and implementation of registry of beneficial owners. Third priority is increased tax transparency, including an improvement of the exchange of information between tax authorities and other entities, which will be based in particular on e-services, which will result in enhanced fiscal literacy and increased voluntary compliance. The fourth priority is improved quality of services, designed to simplify and speed up the procedures and reduce the administrative burden, through increasing digitalized services, better management of the import-export licenses’ issuance, elimination of unnecessary non-tariff barriers and improved internal control and tax control. Five priority is introduction of green taxation, in order to incentivize taxpayers to reduce their polluting behaviors and/or activities.

On the basis of the Strategy, Action Plans with specific action measures, will be prepared annually.