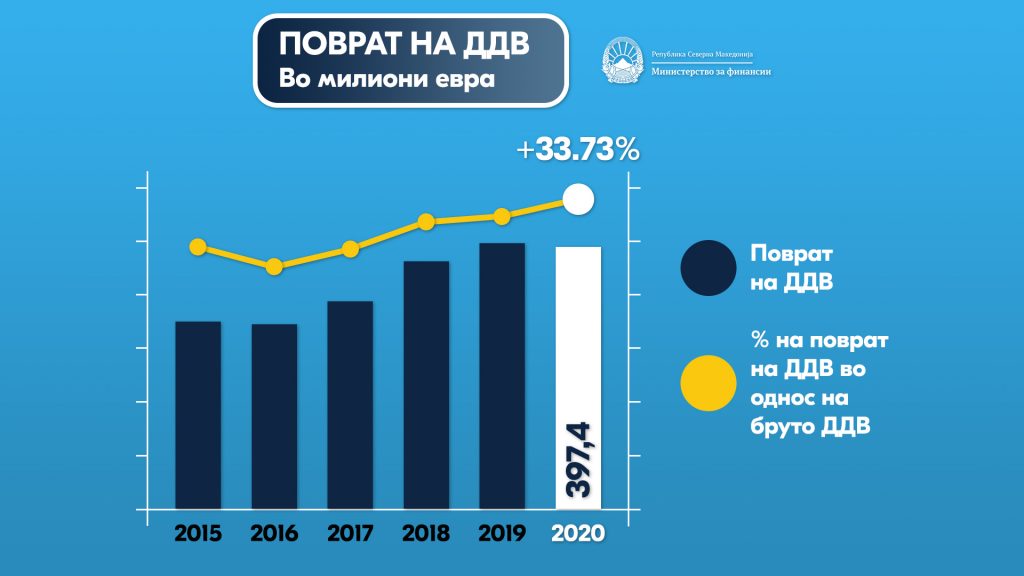

31st January 2021, Skopje – Last year, EUR 397.4 million was injected in the business sector on the basis of VAT refund to the companies. Although 2020 was the year of crisis, VAT refund was the highest last year as a percentage of gross collected tax compared to the past years, while the payment was made on regular basis and with no delays.

Almost 34% of the gross collected VAT was refunded last year. For comparison purposes, VAT refund accounted for 32% in 2019, 31% in 2018, 28% in 2017, 26% in 2016 and 28% in 2015.

In absolute amounts, despite the crisis last year, high amount of VAT was refunded to the companies compared to the previous years. VAT refund amounted to EUR 397.4 million last year, EUR 403.9 million in 2019, EUR 375.8 million in 2018, EUR 315 million in 2017, EUR 280 million in 2016 and EUR 283.5 million in 2015.

Refunding VAT to the companies on regular basis and in a timely manner is of huge importance for the liquidity of the business sector, especially in times of crisis when access to funds is limited.