1st June 2023, Skopje – The fourth working meeting for monitoring the implementation of the Financial Education and Financial Inclusion Strategy was held on 31 May, under the coordination of the National Bank, attended by representatives of the Ministry of Finance, the Securities and Exchange Commission, the Agency for Supervision of Fully Funded Pension Insurance and the Insurance Supervision Agency, as well as the private and civil sector entities. A representative of the Organisation for Economic Co-operation and Development (OECD) attended the meeting and presented the results of the 2022 survey on financial literacy of micro-, small and medium-sized enterprises (MSMEs) in South East Europe (SEE). The ensuing report titled Financial Literacy and Digitalisation for MSMEs in SEE: A Tool for Empowering Owners and Managers was prepared in the framework of the regional project of the OECD and its International Network on Financial Education (INFE) carried out with the support of the Netherlands’ Ministry of Finance and its Money Wise platform. The report offers evidence and analysis of the financial literacy levels of MSME owners and managers, their awareness and use of financial services and the digitalization of MSME financial and business activities, allowing for comparisons among survey participants from the region, including our country.

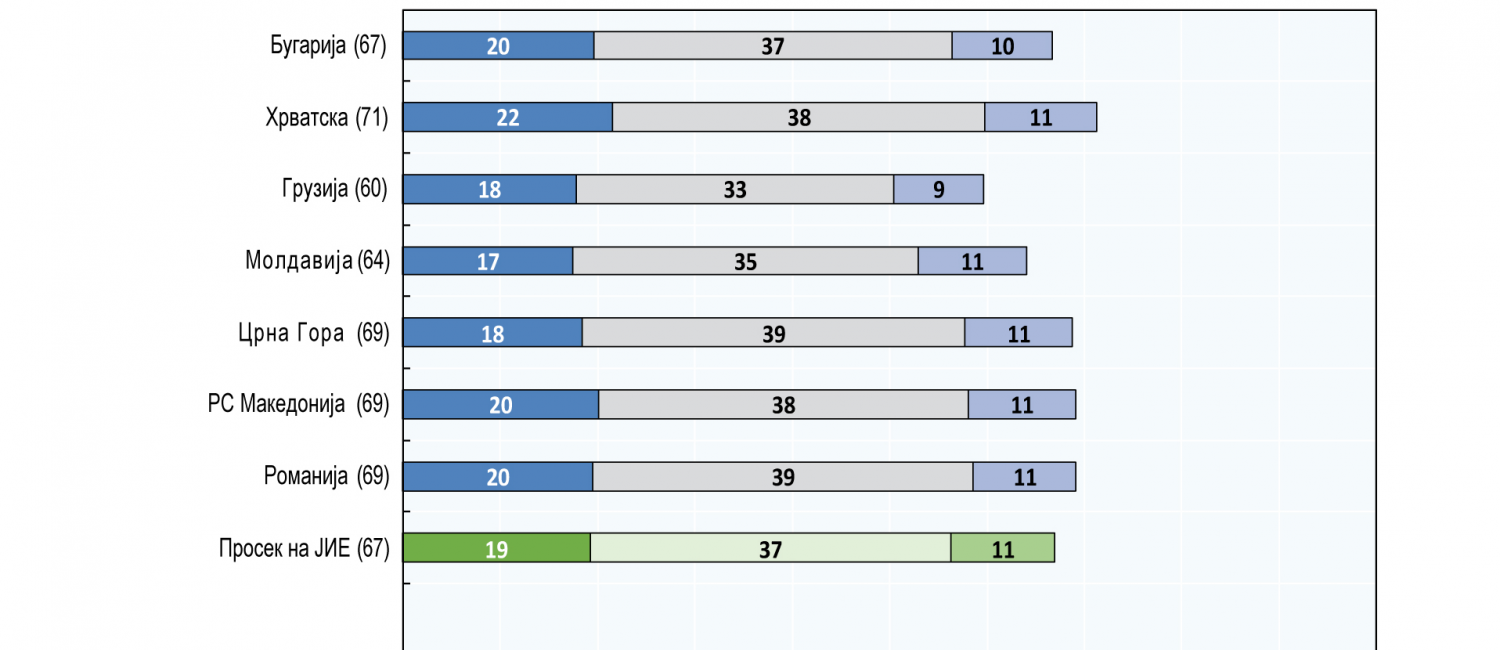

The financial literacy score of MSME managers and owners in our country was 69 (out of 100) which is higher compared to the average of the analyzed countries from the region (67). The highest scores were achieved for the component financial behavior, followed by financial knowledge and financial attitudes, whereby all components are slightly above or at the level of the regional average. Compared to G-20 countries, the average score of the region is lower by 7 pp, which points to the need for enhanced financial skills and strategic approach to increasing the financial literacy of MSME managers, in order to strengthen the long-term business resilience of these companies. The comparison of our results in terms of MSME awareness of financial products shows that the awareness of MSME owners and managers using loans for business financing in our country is higher compared to the regional average, while in the other rated parameters- awareness of capital funding and other types of funding and risk management awareness, the scores are slightly lower or are in line with the results in the region. The findings point to the benefit of further capital market development and alternative ways of financing, in order to expand the finance options available for MSMEs, their owners and managers.

In terms of digitalization, our average score is slightly lower compared to the region. Moreover, the digitalization of the MSME in the region is estimated to have lagged behind the levels observed in developed countries, which points to the need for further improvement.

The findings and the conclusions of the report offer useful evidence in support of further work on financial education and financial inclusion of MSME, in accordance with the National Strategy. This would create prerequisites for improvement of the access to finance by MSMEs. The activities in this field are expected to contribute to sustainable development of this segment and of the economy as a whole. At this meeting, the Hungarian experience of using a Digital platform- financial education application Learning-by-doing-financial education was presented, so the private and civil sector had the opportunity to get acquainted with the educational platforms used in other economies.

These working meetings, which are held twice a year, enable regular dialogue between regulators, private and civil sector entities involved in financial education activities, as well as exchange of proposals and experiences about strengthening financial inclusion and consumer protection in the financial system, in order to successfully implement the Financial Education and Financial Inclusion Strategy.