Министерство за финансии

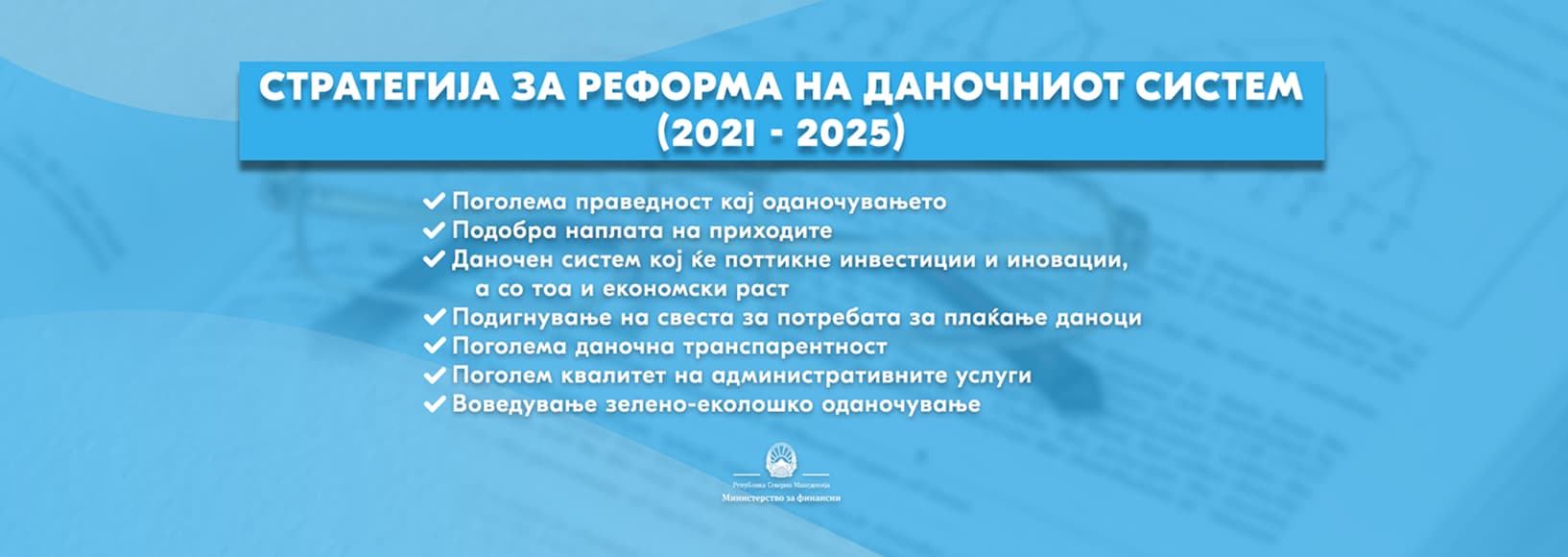

Реформи

Реформи, стратегии, програми и планови на Министерството за финансии

Публикации и објави

Публикации, извештаи и објави на Министерството за финансии

Фискален бројач

Приходи

177014 милиони денари

Реализација

Расходи

207306 милиони денари

Реализација

Капитални расходи

13493 милиони денари

Реализација

Државен долг

8423.2 милиони евра

Процент од БДП

Календар за даночна регулатива

Корисни врски

Образец за финансиски извештај на учесниците во изборна кампања

Образец за финансиски извештај на учесниците во изборна кампања

open link hereИзвештај на радиодифузери и печатени и електронски медиуми

Извештај на радиодифузери и печатени и електронски медиуми

open link here#МојДДВ

Мој данок, моја заштеда!

Мој данок, моја заштеда! Скенирај фискални сметки и добиј 20% поврат на ДДВ за купените македонски добра и услуги односно 10% за останатите добра и услуги преку апликацијата #МојДДВ.

Со ова на сите граѓани им овозможуваме да направат поврат на ДДВ-то кое го плаќаат и директно придонесуваме кон враќање на парите назад кон граѓаните.

Буџетски трошоци во изборен период

Предизборен финансиски извештај